georgia ad valorem tax refund

Georgia may have more current or accurate information. To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000 and request a Summary of Benefits letter.

An Independent Contractor Who Receives 1099 Misc Forms Instead Of W 2s May Want A Second Pair Of Eyes On Their Returns Tax Write Offs Tax Prep Tax Preparation

Instead the purchased vehicles are subject to a one-time title ad valorem tax TAVT.

. Some of the taxes levied may not be collected for various reasons assessment errors insolvency bankruptcy etc. The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate. The property taxes levied means the taxes charged against taxable property in this state.

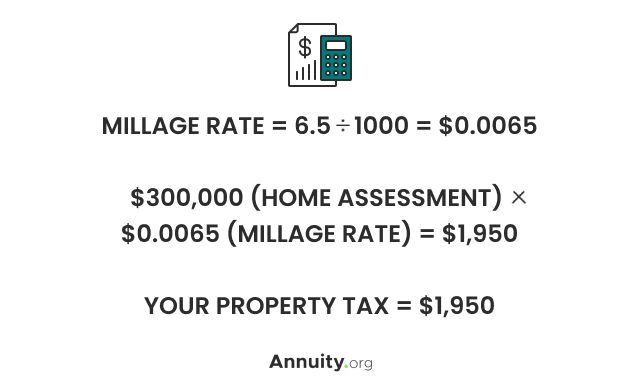

The information on this page is intended to proved some basic information on the treatment of real estate taxes also known as ad valorem taxes in Georgia. The basis for ad valorem taxation is the fair market value of the property which is established as of January 1 of each year. To itemize your deductions for ad valorem taxes you have to give up your standard deduction.

Instead the purchased vehicles are subject to a one-time title ad valorem tax TAVT. For the answer to this question we consulted the Georgia Department of Revenue. Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from sales and use tax and the annual ad valorem tax ie.

Georgia Department of Revenue March 1 2013 Titled motor vehicle purchased on or after March 1 2013. The basis for ad valorem taxation is the fair market value of the property which is established as of January 1 of each year. Income Tax Refunds Learn about income taxes and tracking tax refunds.

This ad valorem tax is deductible each year. The Ad Valorem Tax or the Property Tax is based on value. This tax is based on the value of the vehicle.

Learn how Georgias state tax laws apply to you. Ad Valorem Vehicle Taxes If you purchased your vehicle in Georgia before March 1 2013 you are subject to an annual tax. This tax is based on the cars value and is the amount that can be entered on Federal Schedule A Form 1040 Itemized Deductions for an itemized deduction if the return qualifies to itemize deductions rather than take the standard deduction.

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. Learn how Georgias state tax laws apply to you. CHAPTER 5 - AD VALOREM TAXATION OF PROPERTY ARTICLE 4 - COUNTY TAXATION 48-5-241 - Refund or credit of county taxes OCGA.

Track a Tax Refund. Ad Valorem Vehicle Taxes If you purchased your vehicle in Georgia before March 1 2013 you are subject to an annual tax. Request an additional six months to file your Georgia income tax return.

Property taxes along with collections of sales tax licenses and permit fees fines and forfeitures and charges for services bring in the majority of the funds to operate. The deductions typically adjust up with inflation every year. The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate.

If you purchase a vehicle or bring a vehicle into Georgia before or during your 30 day registration period ad valorem tax is. The Property Tax is part of a well balanced revenue system that is designed to spread the tax burden to all citizens who benefit from the Government. Thus the tax would be deductible on Schedule A of Form 1040 if you itemize as part of your state and local sales tax paid however if you choose to deduct sales tax.

The State Revenue Commissioner is responsible for examining the tax digests of counties in Georgia in order to determine that property is assessed uniformly and equally between and within the counties OCGA. Quick Links Georgia Tax Center. The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those.

Complete Edit or Print Tax Forms Instantly. The links below are reports that show the ad valorem taxes that were levied by local counties schools and cities for the indicated tax year. Related Agency Department of Revenue.

The study also found that there is 47 million acres of rural woodland in Georgia not enrolled in a conservation tax program such as CUVA or FLPA which faced tremendous pressure with ad. In addition the State levies ad valorem tax each year in an amount which cannot exceed one-fourth of one mill 00025. Instead it appears to be a tax in the nature of a sales tax.

A refund complete an Application for Refund of Ad Valorem Taxes Form DR-462 and submit it. This calculator can estimate the tax due when you buy a vehicle. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session.

If itemized deductions are also. If a vehicle is used for business the title tax should be added to the cost basis like a sales tax. Georgias forestland property tax is among the highest in the South at an average of 665 per acre.

The GDVS can only verify the status of a. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. For the 2014 tax year the standard deduction is worth 6200 9100 or 12200 depending on if you file taxes alone as a head of household or as a married couple filing jointly.

Ad valorem tax more commonly known as property tax is a large source of revenue for local governments in Georgia. The tax is levied on the assessed value of the property which by law is established at 40 of fair. The new Georgia Title Ad Valorem Tax TAVT is not deductible as a property tax as it is not imposed on an annual basis.

Ad valorem tax is computed by multiplying the State-assessed value by the local millage rate. It is important for property owners to understand the tax and billing process since tax bills constitute a lien on the property on January 1st of each year. TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles.

Track a Tax Refund. Related Topics Ad Valorem Vehicle Taxes. Any questions pertaining to tax exemptions at the local level should be asked to and answered by your County Tax Commissioners office.

This tax is based on the value of the vehicle. The tax is due during the 30 day period ending at midnight on your birthday or for businesses within your renewal month. We make no warranties or guarantees about the accuracy completeness or adequacy of the information contained on this site or the.

Ad Access Tax Forms. For vehicles purchased in or transferred to Georgia prior to 2012 there is still an ad valorem tax assessed annually and based on the value of the vehicle. Ad Valorem Taxation Land Conservation.

2021 Property Tax Bills Sent Out Cobb County Georgia

How Taxes On Property Owned In Another State Work For 2022

2013 Vehicle Valuation Manual Title Ad Valorem Tax Diminished Value Of Georgia

Deducting Property Taxes H R Block

![]()

Georgia New Car Sales Tax Calculator

Property Taxes Calculating State Differences How To Pay

Learn More About Georgia Property Tax H R Block

What You Need To Know About Condo Property Tax

Ad Valorem Tax Definition Day Trading Terminology Warrior Trading

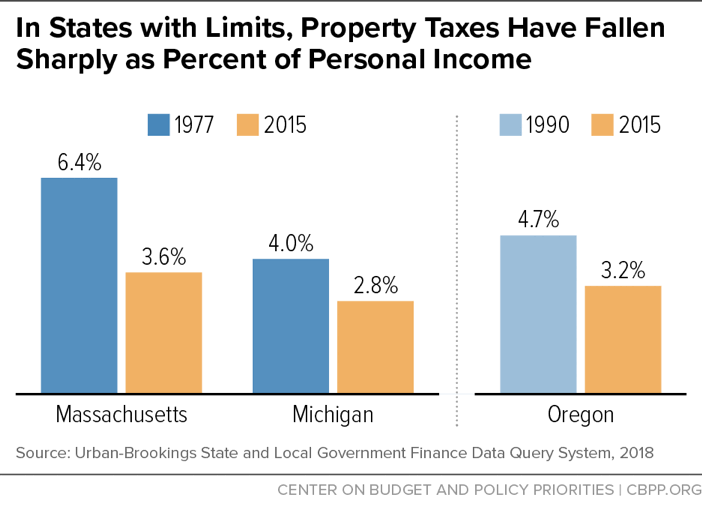

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Get Paid To Complete Offers At Treasuretrooper Com Offer Completed Paying

Types Of Taxes Income Property Goods Services Federal State

Free Standard Rental Agreement Form Printable Real Estate Forms Real Estate Forms Real Estate Lease Rental Agreement Templates

Tax Form W 2 Worksheet W2 Lesson Plan Teaching Taxes

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

What Is A Homestead Exemption And How Does It Work Lendingtree